November 24, 2022

The company, which is undergoing rapid growth in recent years, wants to derive meaningful insights from its data to deliver superior business outcomes.

THE CHALLENGE

The client is India’s only payments company with multichannel transaction processing capabilities—web, mobile, in-store or at the time of delivery. The company has a payments platform to manage payments automation, consumer credit distribution and SME lending, which has become a benchmark in their markets.

With the company gaining rapid growth in the last few years, there was an urgent need to develop new data-driven business models that would empower them to take mission-critical business decisions. This need was being fulfilled by static business intelligence (BI) reports, which lead to numerous challenges. Insights gained from these reports and the existing data processing and storage techniques lacked the desired effectiveness, impacting the user experience and the ability to derive a holistic view of data.

The company sought to re-design and create an enterprise data warehouse to improve the overall system, ensure better BI experience, drive scalability, and more importantly, leverage cloud capabilities.

THE SOLUTION

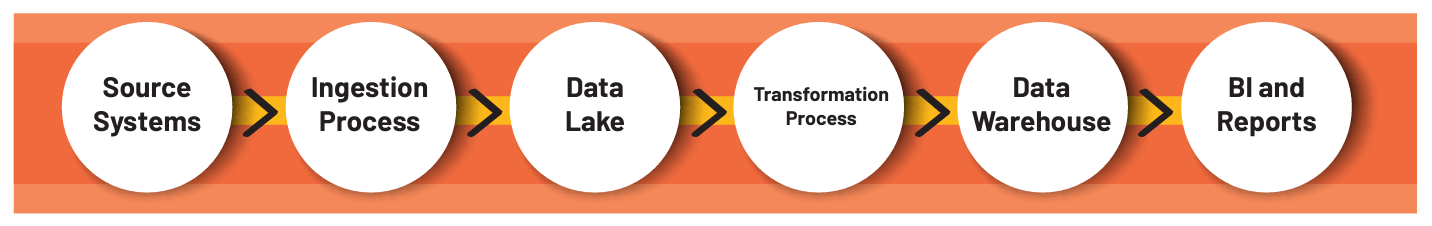

Since the aim was to drive high level of efficiencies in the data management and warehousing practices, Prescience, a Movate company made a detailed study of the client’s existing transaction data, operational data stores, reporting infrastructure and analytics and reporting needs. Keeping the usage considerations and scope of growth in mind, the team designed the architecture with the following considerations:

- Support for structured/semi-structured/unstructured data

- Customer-centric process

- Support analytics and machine Learning – ease of availability of historical data

- Varied high-performance dashboards and reports

- Pentaho for data transformation

- Postgres for on-prem data warehousing

- AWS (Database Migration Service, S3, Lambda, Glue and Redshift)

- Power BI for dashboards and reports Source systems databases

- MySQL and Cassandra

THE IMPACT

Armed with meaningful and actionable insights through data-driven business models, the client is now on the path to achieve significant cost reductions and ROI improvements. Decision makers now have access to good quality and consistent data, enabling them to get a consistent and holistic view of the organization’s financial health, productivity and growth. In addition, business users can now tap highly relevant and accurate data to derive deep insights in the areas of customer demand trends, churn behavior and relation of churn to customer support.